Mobile Money Fraud: What Safety Measures Should You Consider?

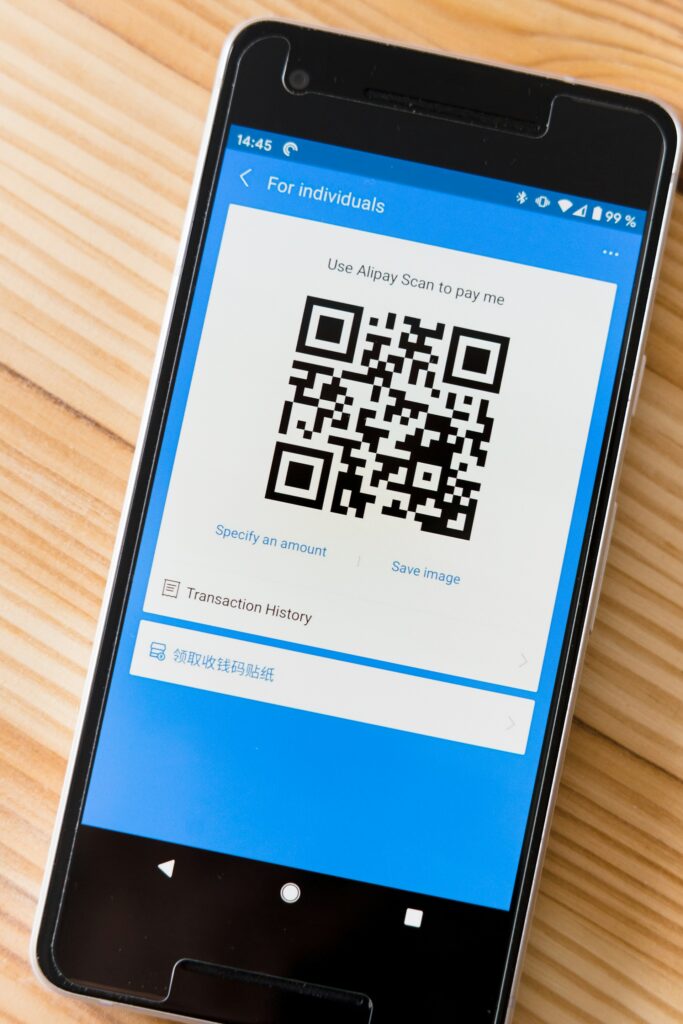

In the rapidly evolving landscape of digital finance, mobile money services have emerged as a convenient and efficient means of financial transactions. From sending money to paying bills and accessing loans, these services offer unparalleled convenience

However, with the rise in popularity of mobile money, so too has the threat of fraud increased.

This article aims to shed light on the various types of mobile money fraud and equip users with actionable steps to protect themselves in the ever-changing digital realm.

The Growing Threat of Mobile Money Fraud

As mobile money services gain traction, they become an attractive target for cybercriminals looking to exploit unsuspecting users. Statistics from major service providers reveal a concerning trend – a surge in fraud-related complaints and the constant evolution of tactics employed by scammers.

Instances of Mobile Money Fraud:

1. The Sophisticated Phishing Operation:

Imagine receiving an official-looking email claiming to be from your trusted mobile money service provider. The email states that urgent action is required to update your account details to avoid service disruption.

It includes a link purportedly leading to the official website. Unsuspecting users, fearing potential issues with their accounts, click on the link and unknowingly provide cybercriminals with their login credentials and other sensitive information.

Armed with this data, the fraudsters gain unauthorized access to the victim’s mobile money account, conducting unauthorized transactions.

Preventive Measures: Users should always verify the legitimacy of emails and messages from service providers. Instead of clicking on links, access the provider’s website directly through a secure browser or contact customer support to confirm the authenticity of any communication.

2. Social Engineering in Action:

In this scenario, a cybercriminal exploits the trust and emotional connection between family members. The scammer calls a user, pretending to be a distant relative in urgent need of financial assistance.

They claim to be in a difficult situation, such as being stranded in a foreign country. To enhance the illusion, they may have gathered information about the family from social media. The unsuspecting user, eager to help their supposed relative, transfers a significant sum of money via mobile money. Only later do they realize that they fell victim to a well-crafted social engineering scheme.

Preventive Measures: Users should exercise caution when receiving unexpected calls or messages requesting urgent financial assistance. Always verify the identity of the caller by asking personal questions that only the real family member would know. Confirm the situation with other family members before proceeding with any transactions.

These real-world instances highlight the diversity and cunning nature of mobile money fraud. By being aware of such scenarios and adopting the preventive measures outlined in the guide, users can significantly reduce their risk of falling prey to these sophisticated schemes.

As we navigate the digital financial landscape, staying informed and vigilant is paramount to ensuring a secure and confident experience with mobile money services. #StaySecure #MobileMoneySafety

What are the types of Mobile Money Fraud?

1. Phishing Scams:

Phishing scams involve cybercriminals posing as legitimate mobile money service providers, tricking users into clicking on malicious links that compromise their private information.

2. Social Engineering:

Scammers use social engineering to impersonate friends, family, or mobile money personnel, convincing users to authorize fraudulent money transfers.

3. Fake Mobile Money Agents:

Fraudsters pose as mobile money agents, helping with transactions while their real intent is to deceive users and siphon their funds.

4. Sim Swap Fraud:

In Sim Swap Fraud, cybercriminals attempt to manipulate mobile network providers to transfer a victim’s phone number to a new SIM card under their control, gaining unauthorized access to the victim’s account.

How To Safeguard Against Mobile Money Fraud

Now that we understand the various tactics employed by cybercriminals, let’s explore practical steps users can take to protect themselves and their mobile money accounts.

How to Protect Yourself from Mobile Money Fraud:

1. Verify Messages and Links:

Exercise caution with unsolicited messages or emails containing links. Verify the sender’s identity and the authenticity of links before clicking. Contact customer support for assistance.

2. Protect Personal Information:

Never share your mobile money PIN, verification codes, or personal information. Be wary of requests for PIN entry under false pretences. If in doubt, change your PIN and report any misuse immediately.

3. Report Suspicious Activities:

Always report suspicious transactions promptly. Reporting helps in locating and apprehending cybercriminals, contributing to the overall security of the system.

4. Be Wary of Anonymous Calls:

Avoid refund requests from anonymous callers claiming you received money in error. Verify your balance independently and contact your service provider for assistance.

5. Avoid Unsolicited Messages (Scams):

Beware of messages promising unexpected cash or prizes. Exercise critical thinking and refrain from providing personal information or making payments in response to such messages.

6. Confirm App Authenticity:

Before downloading payment apps, confirm their legitimacy. Cybercriminals often create fake apps mimicking legitimate ones. Activate two-factor verification for added security.

7. Watch Out for Impersonators:

Verify the identity of anyone claiming to be a mobile money agent before proceeding with transactions. Report suspicious behavior promptly.

The Future of Mobile Money: Innovations and Security Advancements

As we navigate the present challenges of mobile money fraud, it’s crucial to also look towards the future, where innovations and security advancements promise to shape the landscape of digital finance. Here are some anticipated developments in the future of mobile money:

1. Biometric Authentication:

With the rise of biometric technology, the future of mobile money is likely to see increased use of fingerprints, facial recognition, and even voice authentication for secure transactions. This would add an extra layer of protection, making it significantly harder for fraudsters to gain unauthorized access.

2. Blockchain Technology:

The implementation of blockchain in mobile money services could revolutionize security. Blockchain’s decentralized nature ensures that transaction data is securely encrypted and tamper resistant. This technology has the potential to enhance transparency and reduce the risk of fraudulent activities.

3. AI-Powered Fraud Detection:

Artificial Intelligence (AI) will play a pivotal role in the future of mobile money security. Advanced AI algorithms can analyse transaction patterns, detect anomalies, and promptly flag potentially fraudulent activities. This real-time detection capability will add an extra shield against emerging cyber threats.

4. Tokenization for Enhanced Privacy:

Tokenization involves replacing sensitive data, such as credit card numbers, with unique tokens. In the context of mobile money, this could mean generating temporary tokens for transactions, reducing the risk of personal information exposure even if intercepted by cybercriminals.

5. Advanced Encryption Standards:

Future mobile money platforms are likely to adopt more robust encryption standards. End-to-end encryption and quantum-resistant cryptography will become imperative to protect user data and financial transactions from evolving cyber threats.

6. Integration with Emerging Technologies:

Integration with emerging technologies like 5G and the Internet of Things (IoT) will redefine the user experience. Faster and more reliable connectivity will enable seamless and secure mobile money transactions, ensuring users can access their funds without compromising security.

7. Regulatory Framework Strengthening:

Governments and regulatory bodies will play a pivotal role in shaping the future of mobile money. Strengthening regulatory frameworks, imposing stringent security standards, and collaborating with service providers will create a more resilient ecosystem.

8. User Education and Awareness:

Empowering users with knowledge about potential threats and best practices for secure mobile money usage will remain a cornerstone. Educated users are better equipped to recognise and thwart fraud attempts, contributing to an overall safer digital financial environment.

The Future Of Mobile money

The future of mobile money holds exciting possibilities, with advancements geared towards providing users with not only increased convenience but also enhanced security. By embracing these innovations and remaining vigilant, both service providers and users can contribute to a digital financial landscape that prioritises safety and trust.

As we move forward, the integration of cutting-edge technologies and a collective commitment to security will shape a future where mobile money is both seamless and secure. #FutureOfMobileMoney #DigitalFinanceInnovation

As mobile money services continue to transform the way we handle finances, it’s crucial to stay vigilant against the evolving threat of fraud.

By following the outlined steps and maintaining a proactive approach, users can safeguard their digital wallets and transact with confidence., let’s be smart, diligent, and united in protecting our financial security. #DontLooseGuard